DISCLAIMER: This article does not create an attorney-client relationship between the author and the reader. The answer of the author on the issue is just an expression of his general opinion based on Philippine law and hence does not constitute legal advice.

You are employed and at the same time you are running a business. In other words, you work very hard. This is a situation of a friend who, on several occasions, has asked me whether her kids get higher share than his spouse in the properties she acquired from her salary and business, in case she leaves this mother earth.

In the absence of a prenuptial agreement or where the prenuptial agreement is invalid, the property regime of couples married on or after the effectivity of the Family Code (August 3, 1988) is absolute community of property (Article 91 of the Family Code). In a nutshell, absolute community of property is a property regime where all the properties of the spouses at the time of the celebration of the marriage and all the properties acquired during the marriage are properties of both spouses except (Article 92 of the Family Code):

- Properties acquired during the marriage by gratuitous title (like inheritance and donation) including the fruits and income therefrom, unless otherwise specified by the testator, donor, or grantor.

- Properties for the exclusive use of either spouse except jewelries.

- Properties acquired before the marriage by either spouse who has legitimate descendants by a former marriage, including the fruits and income therefrom.

Applying the provisions of the Family Code, the properties acquired by my friend from her salary and business during the marriage are part of their community or conjugal properties. How will these properties be distributed (including all their other conjugal properties), in case her time comes?

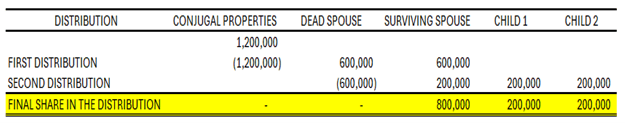

For better appreciation and to simplify the discussion, assume the value of the conjugal properties is PHP1.2 million, the spouses have two legitimate children, no debts, no prenuptial agreement, and the dead spouse has left no will. The distribution is below.

Is the distribution fair? Be it fair or not from one’s view, the provision of the law must be followed. The law may be harsh, but it is the law. The net conjugal properties shall first be distributed equally between the spouses in accordance with Article 102(4) of the Family Code and finally the share of the dead spouse (plus net exclusive property, if any) shall be distributed in accordance with the applicable provision of the Civil Code on succession. In the instant case, Article 996 of the Civil Code applies to distribute the net estate to the intestate heirs.

In actual, the distribution may not be as simple as illustrated above as the process involves documentation, appraisal of property, publication, court intervention in some cases, and payment of debts, taxes, and expenses to arrive at the net value of the conjugal properties distributable to the spouses and finally to the heirs.

(February 28, 2025)

Leave a comment