DISCLAIMER: This article does not create an attorney-client relationship between the author and the reader. The answer of the author on the issue is just an expression of his general opinion based on Philippine law and hence does not constitute legal advice.

This article is best appreciated when read in relation to my first article, AVOIDING OR MINIMIZING TAX. Take the case below to discuss the issue.

A sucessful Filipino entrepreneur in Metro Manila has been advised to convert his single proprietorship business to a corporation to save income tax. Because the business has more than PHP8million in taxable income, it is taxed at 35%, the highest tax bracket for individual taxpayer. If the business is converted to a corporation, it will fall under the 25% regular corporate income tax.

Is there a tax benefit (or tax payment reduction) when the business converts to a corporation?

From a layman’s perspective, what matter most is the income that can freely be disposed, net of all expenses and taxes. The form of business is sometimes ignored.

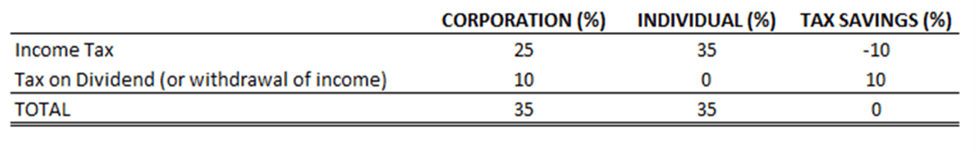

To facilitate the discussion, refer to the absolute tax rates below:

Under the National Internal Revenue Code (NIRC), as amended, the corporate income tax rate for domestic corporation beginning July 1, 2020 is 20% if its net taxable income does not exceed PHP5million and its total assets (excluding the land where the business is situated) do not exceed PHP100million. If a domestic corporation does not meet these criteria, the income tax rate is 25%. Any income distributed by a domestic corporation as cash dividend to a stockholder who is a citizen of the Philippines is subject to a 10% final withholding tax.

For resident citizen, the income tax rate ranges from 0% to 35% on income within and without the Philippines.

Approximately and as a quick answer to the issue, there is no tax benefit or tax reduction when the business in the instant case converts from single proprietorship to corporation. Why? Although the corporation’s income tax is only 25% as against the 35% income tax for individual, the 10% difference is offset by the 10% final tax on cash dividend (refer to the schedule of absolute tax rates above). A resident citizen before he is allowed to withdraw the net income of his corporation, a 10% final tax must be paid or deducted from the amount being withdrawn as dividend.

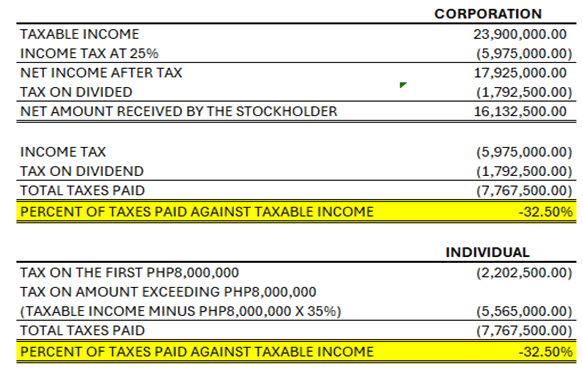

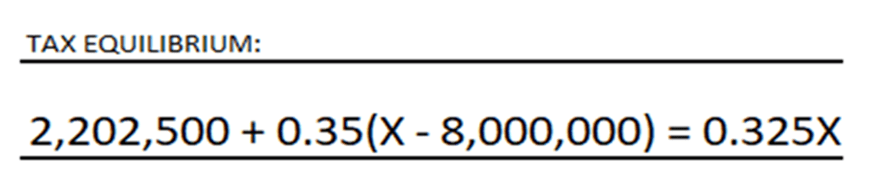

As accountant, I made computations to complete the discussion. I computed the point of equilibrium where there is no tax difference. Below the equilibrium, single proprietorship provides greater tax benefit but above the equilibrium, corporation now provides greater tax benefit. Mathematically, if the taxable income does not exceed PHP23.90 million, the suggestion is to retain the business as single proprietorship. But the moment the taxable income exceeds PHP23.90 million, the suggestion is to convert the business to a corporation.

Interested on the computation of the PHP23.90 million point of equilibrium? Refer to my computation below. The computation shows that at PHP23.90 million taxable income, there is no tax difference between corporation and single proprietorship:

The tax equilibrium at PHP23.90 million is computed using the equation below. At 25% corporate income tax rate, the effective tax rate is 32.50% because of the 10% final tax on cash dividend.

For single proprietorship with income tax rate below 35%, the same principles apply in the computation to determine the point of equilibrium or the taxable income where there is no tax difference between single proprietorship and corporation.

Note that the suggestion, either to retain as single proprietorship or to convert as corporation, is taxation point of view. You may want to read my article, MAY A CREDITOR OF THE SUBSIDIARY COMPANY REACH THE ASSET OF THE PARENT COMPANY TO SATISFY ITS CLAIM?, to give you an overview of corporation’s limited liability as embodied under the Revised Corporation Code of the Philippines. A corporation is liable only to the extent of its assets to satisfy the claims of the creditors whereas an owner of a single proprietorship is liable up to the extent of his personal assets.

Which one is right for you? Single proprietorship or corporation? Check again!

(March 30, 2024)

Leave a reply to ESTATE PLANNING – Beginner’s Insights Cancel reply