DISCLAIMER: This article does not create an attorney-client relationship between the author and the reader. The answer of the author on the issue is just an expression of his general opinion based on Philippine law and and hence does not constitute legal advice.

Did my employer correctly compute withholding tax on my compensation? This is the common question of many employees at the end of every calendar year. Many are happy if they get tax refund, and many are also sad if additional withholding tax is deducted from their last pay of the year.

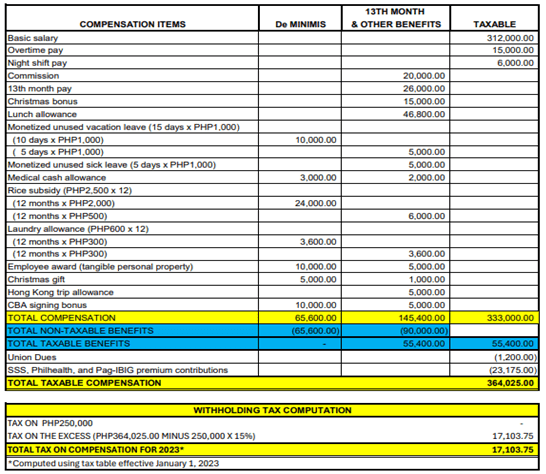

The application of the de minimis benefits and the 13th month pay and other benefits in the so called “annualization of withholding tax’’ sometimes creates confusion resulting to errors in the tax computation. Allow me to clarify the application of these two items of non-taxable income using the case below.

Here we go!

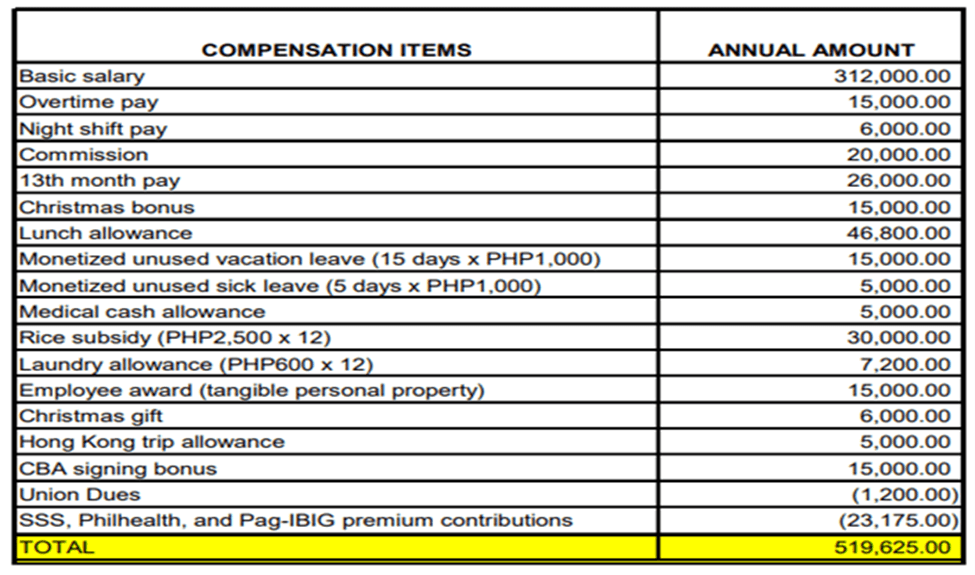

A non-managerial and non-supervisory employee received the following compensation for calendar year 2023 from his private employer:

Compute his taxable income and withholding tax on compensation.

Unless tax-exempt by provision of law too plain to be mistaken, all compensation paid to the employee, whether in cash or in kind, is subject to withholding tax.

Revenue Regulation (RR) 2-98, as amended enumerates payments or benefits paid or provided by the employer which are tax-exempt, and thus, not subject to withholding tax. Two of these tax-exempt payments or benefits relevant to the instant case are the “de minimis benefits” and the “13th month and other benefits not exceeding PHP90,000.00”.

Under Revenue Memorandum Circular (RMC) 50-2018, as amended any amount of de minimis benefit in excess of the maximum amount allowed as “de minimis” shall be included as part of the “13th month and other benefits” which is subject to the PHP90,000.00 ceiling. Any amount in excess of the PHP90,000 shall be subject to income tax, and consequently, to the withholding tax on compensation.

The following are the “de minimis” benefits:

1) Monetized unused vacation leave credits of private employees not exceeding ten (10) days during the year;

2) Monetized value of vacation and sick leave credits paid to government officials and employees;

3) Medical cash allowance to dependents of employees not exceeding P1,500.00 per employee per semester or P250.00 per month;

4) Rice subsidy of P2,000.00 or one (1) sack of 50 kg. rice per month amounting to not more than P2,000.00;

5) Uniform and clothing allowance not exceeding P7,000.00 per annum (as amended by RR 4-2025);

6) Actual medical assistance, e.g., medical allowance to cover medical and healthcare needs, annual medical/executive check-up, maternity assistance, and routine consultations, not exceeding P10,000.00 per annum;

7) Laundry allowance not exceeding P300.00 per month;

8) Employees achievement awards, e.g., for length of service or safety achievement, in any form, whether in cash, gift certificate or any tangible personal property, with an annual monetary value not exceeding P10,000.00 received by the employee under an established written plan which does not discriminate in favor of highly paid employees (as amended by RR 4-2025);

9) Gifts given during Christmas and major anniversary celebrations not exceeding P5,000.00 per employee per annum;

10) Daily meal allowance for overtime work and night/graveyard shift not exceeding twenty-five percent (25%) of the basic minimum wage on a per region basis; and

11) Benefits received by an employee by virtue of a collective bargaining agreement (CBA) and productivity incentive schemes provided that the total annual monetary value received from both CBA and productivity incentive schemes combined do not exceed ten thousand pesos (P10,000.00) per employee per taxable year.

Applying these provisions of law in the instant case, the 2023 taxable income and withholding tax on compensation of the employee is PHP364,025 and PHP17,103.75, respectively computed as follows:

The above computation applies also to managerial and supervisory employees except on the benefits exclusively enjoyed by them which shall be subject to the fringe benefit tax defined under RR 2-98, as amended.

For government employees, the computation likewise applies except on the monetization of all their unused vacation and sick leaves which, under RMC 23-2014, is exempted from the withholding tax on compensation. For complete list of compensation of government employees not subject to withholding tax on compensation, kindly refer to the said RMC.

(March 30, 2024)

Leave a reply to ESTATE PLANNING – Beginner’s Insights Cancel reply