DISCLAIMER: This article does not create an attorney-client relationship between the author and the reader. The answer of the author on the issue is just an expression of his general opinion based on Philippine law and hence does not constitute legal advice.

On several occasions, my son who is working in one of the diagnostic clinics in Metro Manila, has asked me how his overtime pay is computed especially during holidays. For his benefit and for the benefit of other workers and employees, I made this article as a reference.

Take this case.

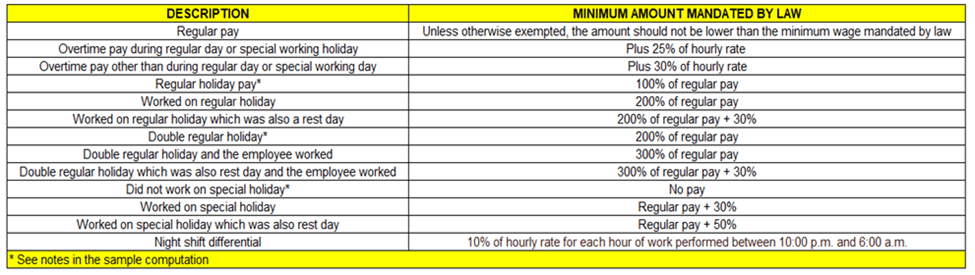

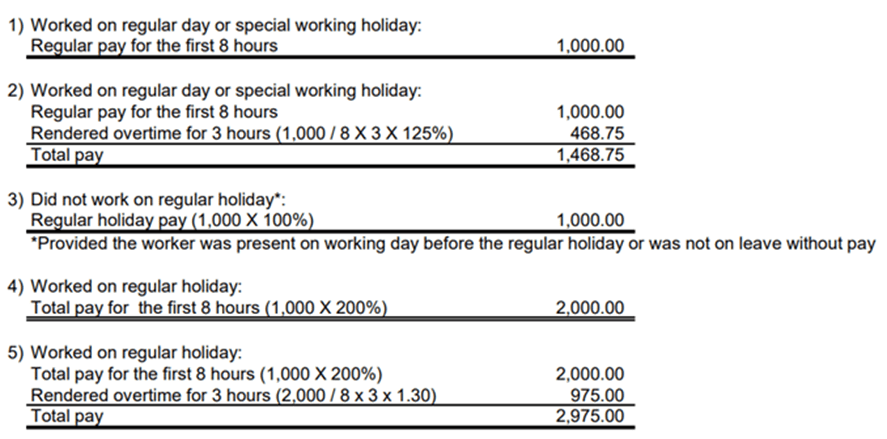

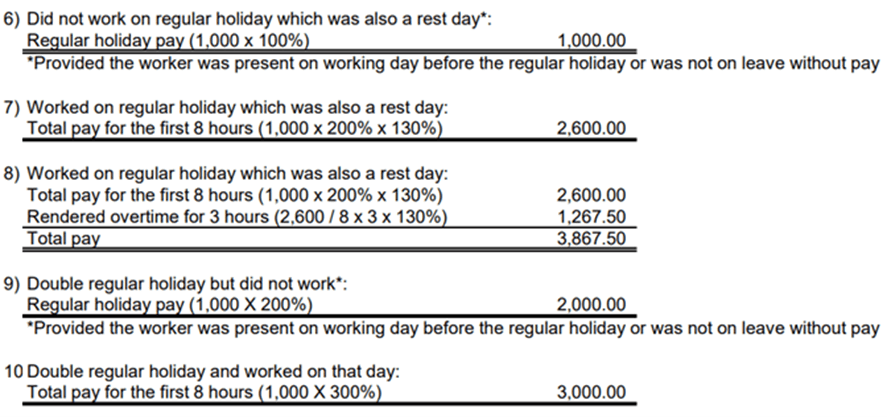

A worker has a daily rate of PHP1,000 for an eight-hour work. Compute his total pay for the day using several scenarios applying the following provisions of law:

The overtime pay and other benefits discussed in this article apply to employees in all establishments and undertakings, whether for profit or not, but not to government employees, managerial employees, field personnel, members of the family of the employer who are dependent on him for support, domestic helpers, persons in the personal service of another and workers who are paid by results as determined by the Secretary of Labor and Employment in appropriate regulations (Article 82 of the Labor Code)

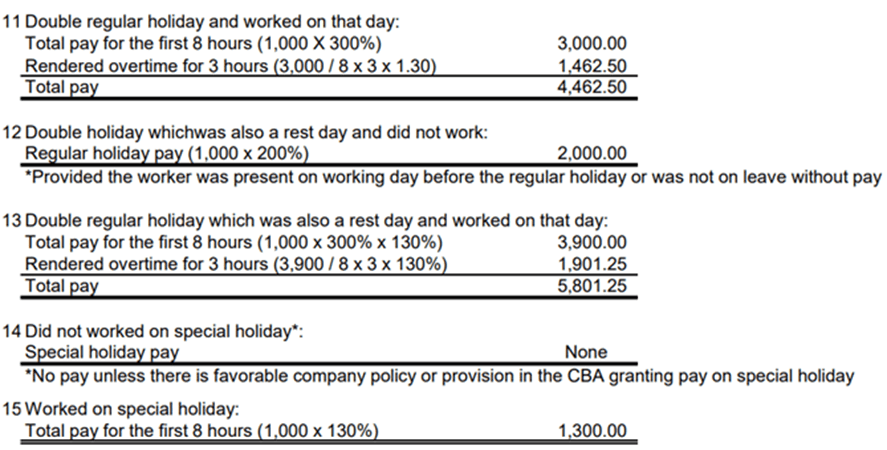

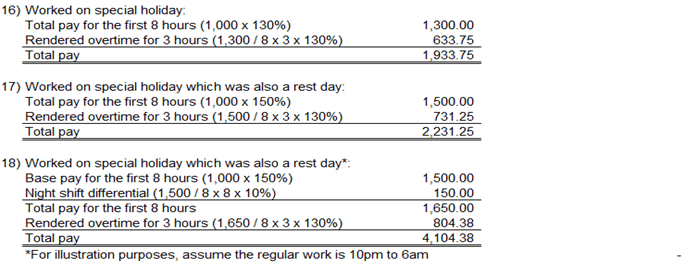

The following are the different scenarios with pay computation as a reference:

Are you ready now to check the computation of your pay in your payslip? Revisit the computation to gain familiarity. Have fun computing!😁

(March 30, 2024)

Leave a reply to ESTATE PLANNING – Beginner’s Insights Cancel reply