DISCLAIMER: This article does not create an attorney-client relationship between the author and the reader. The answer of the author on the issue is just an expression of his general opinion based on Philippine law and hence does not constitute legal advice.

This article is a must-read in relation to my previous article, BASIC GUIDE WHEN BUYING REAL PROPERTY. This article now completes our guide.

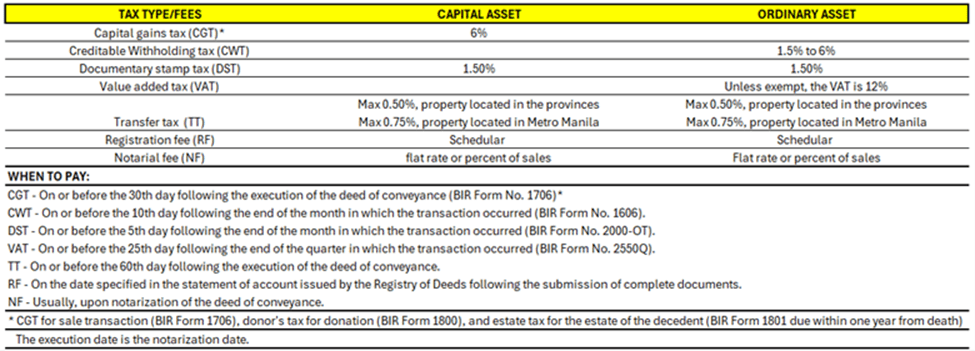

Because tax is a significant amount in a sale transaction, this is always considered in determining the selling price. The tax to be paid depends on the classification of real property. Real property is classified either as capital asset or ordinary asset.

Revenue Regulations (RR) 7-2003 in relation to Section 39(A)(1) of the National Internal Revenue Code (NIRC), as amended classifies the following real properties as ordinary assets.

1) Stock in trade of a taxpayer or other real property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year; or

2) Real property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business; or

3) Real property used in trade or business (i.e., buildings and/or improvements) of a character which is subject to the allowance for depreciation provided under Sec. 34(F) of the NIRC of 1997, as amended; or

4) Real properties used in trade or business of the taxpayer; or

5) Real properties acquired by banks through foreclosure sale.

By the process of exclusion, all other real properties not included in the above enumeration are considered capital assets.

Now that we are clear of the distinction, we now summarize the taxes and fees in a sale transaction of real property. Refer to the table below:

Sale by foreign corporation of its interest in condominium unit or building classified as capital asset is not subject to CGT but the capital gain on such sale is subject to the 25% corporate income tax.

In computing the amount of tax, the tax base is the selling price, the zonal value found in the BIR website, or the market value of the real property in the tax declaration whichever is the highest without prejudice to the newly enacted law (RA 12001 Real Property Valuation and Assessment Reform Act) signed on June 13, 2024 by the President to take effect 15 days following its publication in the Official Gazette or in a newspaper of general circulation.

For other dispositions of real properties:

- Unless exempt, donation of real properties is subject to a donor’s tax of 6% on the net amount of donation.

- Real properties acquired through succession (or inheritance in layman’s lingo) are subject to an estate tax of 6% on the net estate of the decedent.

Donations exempted from the payment of donor’s tax are also exempted from the payment of DST. All other taxes and fees (except CGT and CWT) as summarized in the table are also applicable in donation and in succession.

(June 17, 2024)

Leave a reply to BASIC GUIDE WHEN BUYING REAL ESTATE – BEGINNER'S INSIGHTS Cancel reply